Ignition Cash Transfer Account

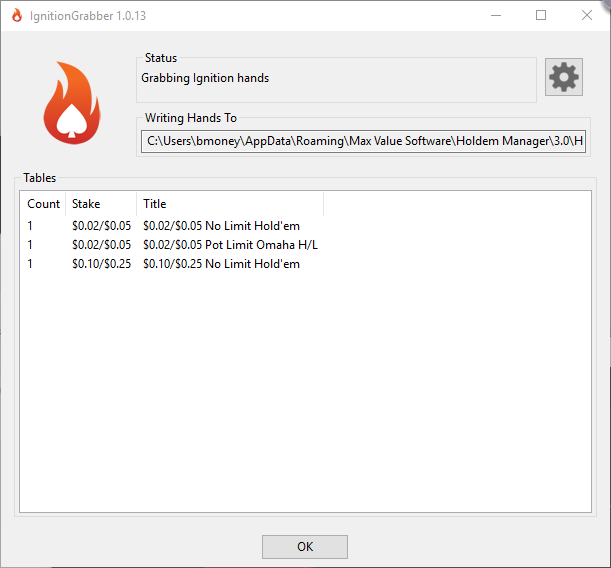

How to Cash Out Quickly From Ignition Poker. As mentioned, Ignition is currently the quickest poker site when it comes to player cash outs. If you are looking for the fastest possible method, we suggest using the money transfer. I called Ignition and they actually verified my account so I thought it was all good. I called Bovada and they said my account was still on hold while they reviewed documents. World’s 3rd Largest Site Traffic Wise. Ignition Poker is one of America’s largest online card rooms in terms of pure traffic to operate outside of the country. Even though Ignition is a fairly new name you must have heard of their alter egos, including Bodog, Calvin Ayre and Costa Rica. Finally, Ignition Poker offers wire transfers, which is fairly rare in the US market. These can only be used for payouts over $1,500, but you receive your funds directly to your bank account.

Enjoy Instant, Safe & Secure Money Transfer with Paytm

Ever wondered if there was a better way to transfer money? Get rid of lengthy process of account number & IFSC additions, waiting for beneficiary activation, transaction getting delayed as NEFT transactions are processed in a fixed slot. Here is Paytm UPI for you to forget Net-banking and do all your bank transfers in the safest and easiest way possible. Money transfer has never been more easy & convenient.

Ignition Cash Transfer Account Capital One

Now transfer money from your bank account to any bank account using Paytm app. You can check balance, transfer money to your friends & family, request money securely on Paytm. Money transfer on Paytm is powered by BHIM UPI, a revolutionary technology which enables payment to your bank account directly using mobile number only. Now, you can transfer money only using UPI address apart from usual “Account Number & IFSC” based money transfer.

All you need to do is link your bank account on Paytm and setup your MPIN. Your MPIN is a 4 or 6 digit passcode, stored securely with NPCI (National Payments Corporation of India). Your account details and MPIN is safe with NPCI and is authenticated with secure servers whenever money is deducted from your account using Paytm UPI.

Here is why you should forget Netbanking forever and adopt Paytm’s “Bank Transfer” feature powered by BHIM UPI -

Ignition Cash Transfer Account Receivable

| Money Transfer using Paytm BHIM UPI | Money Transfer using Net Banking |

|---|---|

Wow, you saved a lot of hassle & time. |

|

Your bank account should be linked to your mobile number & you must be logged-in to Paytm with that mobile number. Follow below steps to access “Bank Transfer” on Paytm -

- On the home screen, click “Bank Transfer” icon on the blue strip on top

- Choose your Bank which has account linked to your Paytm registered mobile number

- After few seconds, all your accounts with that Bank account is shown on-screen

- Click one of the accounts and wait for few seconds till your account is linked

- Now, you need to setup your secure MPIN for transaction authentication

- You can repeat above steps to link all your Bank accounts to Paytm